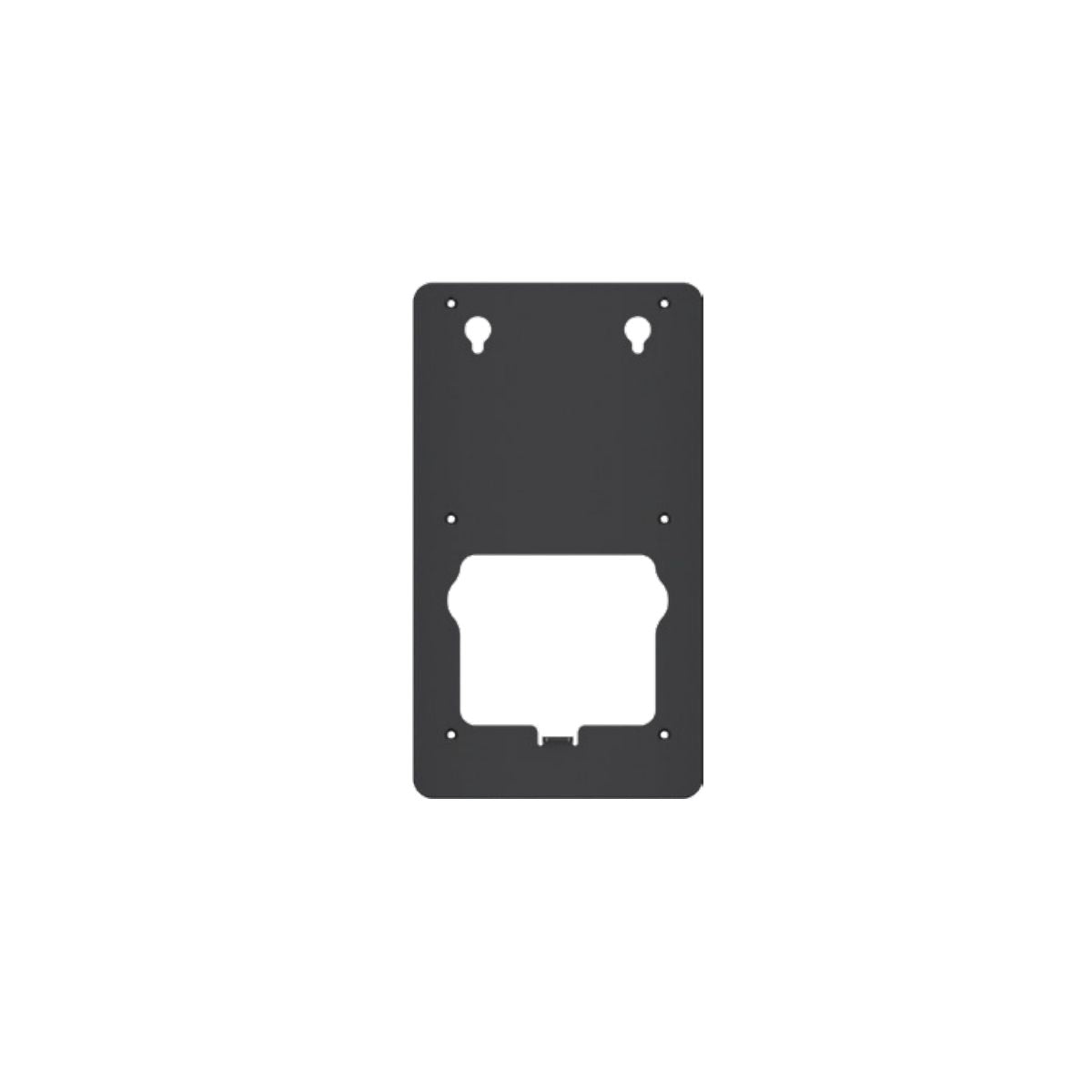

Recessed plaster support with glass cover for LED lamps - 120x120mm

Guarantee Safe Checkout

Pickup available at Sede Operativa Oniroview Usually ready in 24 hours

Pickup available

-

Sede Operativa Oniroview

Pickup available, usually ready in 24 hours

Via Piave 17

Check in google map

95129 Catania CT

Italy

Recessed plaster support with glass cover for LED lamps - 120x120mm

Electrical Characteristics

Max installable power: 10W

Mechanical characteristics

Length: 120mm

Width: 120mm

Height: 60mm

Recess hole: 125 x 125mm

Degree of protection: IP20

Body material: Plaster

Body color: White

Finish: Matte

Diffuser: Opaque glass

Adjustable: no

Glass cover included.

Bulb and socket not included.

Use only the indicated lamp holders:

GU10 (230V): 23-9-104/3

GU5.3 (12V): 23-9-106/3

Have you changed your mind? What should you do?

If you need to return or exchange your order for any reason, we're here to help! We offer returns or exchanges within 30 days from receipt of the order. You can return the product in exchange for a shopping voucher , a different product or a reimbursement directly with the original payment method.

Please note the following exceptions to our return and exchange policy:

- Discounted outlet items are final and cannot be returned or exchanged.

- Returned items must still have the original packaging and/or be returned in the original packaging.

- Returned items must not show visible signs of wear or use (scratches, tears, welds, etc.).

- B2B sales (with invoice)

To initiate a return or exchange, complete the following steps:

- Log in to your registered account on oniroview.com, go to the Orders section, click "Manage" on the order you wish to return, and click "Request Return." Select the products you wish to return or exchange from your order and submit your request.

- Please wait for our return authorization, which we will send to your email address within 48 hours.

- Send all articles to our address: Oniroview Via piave 17, 95129 Catania.

- You have 30 days from the delivery date to return the products. Returning the products after this timeframe will void your right to return them.

To limit damage to the original packaging, we recommend placing it in a second box whenever possible. Avoid placing labels or tape directly on the product's original packaging.

It may take up to 15 working days for us to inspect your order before we can process your refund.

The return must be made at the customer's expense.

Refund Method: Full Refund

You must return it within fourteen days of delivery.

You will be refunded 100% if you cancel your purchase in full (return ALL purchased products).

Refund Method: Partial Refund

If you return the goods between the fifteenth and thirtieth day of delivery, you will be refunded the value of the returned goods, excluding shipping costs.

If a partial return is made on an order that received free shipping, the shipping cost will be calculated and deducted from the refund.

Further information on times and methods

- You can decide to return a product within 30 days of receiving the goods.

- Once you have obtained the return authorization, you will have to send the product back at your own expense.

- Please ensure you package your products appropriately and use secure, tracked shipping. Any products that arrive damaged and/or lost will not be refunded.

- Pursuant to Legislative Decree 206/05, the consumer has the right to withdraw from the contract within 15 working days of receiving the goods, returning the goods subject to withdrawal intact to the seller, who will refund the price of the returned goods, including shipping costs.

If the return is made between the fifteenth and thirtieth day, you will be entitled to a refund only for the returned products.

- If the original internal packaging is damaged, Oniroview will withhold 10% of the refund amount to cover the cost of restoring the goods. This does not include any repair costs for confirmed damage to the original packaging.

-

The right of withdrawal lapses entirely, due to the lack of the essential condition of integrity of the goods (packaging and/or its contents), in cases where Oniroview ascertains:

The absence of integral elements of the product (accessories, cables, manuals, parts, etc.);

The lack of the original external/internal packaging;

Damage to the product for reasons other than its transport or for exceeding the time limits established by law, for reasons not deriving from Oniroview.

In the event of forfeiture of the right of withdrawal, Oniroview will return the purchased item to the sender, charging the latter the shipping costs.

EXCLUSION OF THE RIGHT OF WITHDRAWAL

The right of withdrawal is excluded and, therefore, the preceding paragraphs do not apply to Contracts concluded with Customers with VAT numbers.

Tax deductions and benefits for ordinary and extraordinary maintenance

To request tax breaks, send your request to the email address: amministrazione@oniroview.com

IRPEF deductions at 50%

You are entitled to a 50% deduction for the purchase of products connected to building interventions, such as electrical systems, video intercoms and alarm systems and LED lighting. It is not required to send any documents to our company. To take advantage of the deduction, simply indicate the total expense in your 730 or in the Unico form.

The documents to be kept are:

- Bank transfer receipt

- Purchase invoices showing the nature, quality and quantity of the goods purchased and, preferably, the buyer's tax code

Procedure to follow:

- Place an order on our site by selecting "Bank Transfer" as the payment method.

- Request the invoice and indicate the desired deduction in the order notes.

- Make the payment via bank transfer, compliant with the provisions of the Revenue Agency. The transfer must include:

- Reason for payment (include order number and date)

- Oniroview tax code and/or VAT number: 05660420877

- Tax code of the payer

In the absence of even one of the two fields indicated above, the order will be processed without invoicing.

10% reduced VAT for building renovations and conservative renovations ( 10% REDUCED VAT - 50% TAX DEDUCTION)

Purchase of goods, with the exclusion of raw materials and semi-finished products, used in conservative restoration and building renovation. Use for the purchase of LED lighting is permitted .

Requested documents:

-

Copy of Identity Card

-

Copy of valid tax code or health card

-

Copy of DIA or SCIA or CIL (or building permit) where the "Type of intervention" is indicated

-

Declaration for reduced VAT ( download the form here )

The documents indicated above must be sent to the email address amministrazione@oniroview.com , after completing the order. Once the documentation has been verified, we will issue an advance invoice with the reduced VAT to proceed with the payment.

Procedure to follow:

- Place an order on our site by selecting "Bank Transfer" as the payment method.

- Request the invoice and indicate in the order notes by writing "your tax code and advance invoice for renovation and restoration, VAT 10%" in the same 'Order note' field.

- Make the payment via bank transfer indicating the invoice number

In the absence of even one of the two fields indicated above, the order will be processed without invoicing.

VAT reduced at 4% for the construction of the first non-luxury home

The use of LED lighting for the purchase of non-luxury properties is permitted (the property must not have luxury characteristics, according to the criteria indicated in the decree of 2 August 1969).

Requested documents:

-

Copy of Identity Card

-

Copy of valid tax code or health card

-

Copy of DIA or SCIA or CIL (or building permit) where the "Type of intervention" is indicated

-

Declaration for reduced VAT ( download the form here )

The documents indicated above must be sent to the email address amministrazione@oniroview.com , after completing the order. Once the documentation has been verified, we will issue an advance invoice with the reduced VAT to proceed with the payment.

Procedure to follow:

- Place an order on our site by selecting "Bank Transfer" as the payment method.

- Request the invoice and indicate in the order notes by writing "your tax code and advance invoice for the facilitation of construction of a first home, VAT 4%" in the same field.

- Make the payment via bank transfer indicating the invoice number

In the absence of even one of the two fields indicated above, the order will be processed without invoicing.

Furniture Bonus

Purchase of Furniture and Appliances, including LED lighting for private individuals and condominiums. Legislative decree no. 63/2013 introduced a further 50% deduction for the purchase of furniture and large appliances and LED lighting, aimed at furnishing properties undergoing renovation.

The main prerequisite for obtaining the deduction is the carrying out of a recovery intervention on the building heritage (renovation, restoration, etc.).

It is not required to send any documents to our company. To take advantage of the deduction, simply indicate the total expense in your 730 or in the Unico form.

The documents to be kept are:

- Bank transfer receipt

- Purchase invoices showing the nature, quality and quantity of the goods purchased and, preferably, the buyer's tax code

Procedure to follow:

- Place an order on our site by selecting "Bank Transfer" as the payment method.

- Request the invoice and indicate in the order notes by writing "your tax code and "advance invoice for mobile bonuses" in the same field.

- Make the payment via bank transfer indicating the invoice number

In the absence of even one of the two fields indicated above, the order will be processed without invoicing.

VAT exemption with Reverse Charge and Split Payment

To take advantage of reverse charge and split payment on Oniroview.com, Public Administration suppliers and companies that perform services through procurement and subcontracting contracts must follow this procedure:

- Complete the order on our website by selecting "Bank transfer" as the payment method.

- Specify in the order notes that you have the necessary documentation for VAT-free payment.

- Send the documentation to facilitazioni@oniroview.com , including the order reference.

After verifying the documentation, we will issue an advance invoice with the reduced VAT to proceed with the payment.